Embracing ESG: The Future of Responsible Business Practices

In a world where sustainability and ethical governance form the bedrock of successful enterprises, the integration of Environmental, Social, and Governance (ESG) principles has become more than a trend—it's a strategic imperative. Our deep-dive into ESG unveils how these practices are not just about compliance or goodwill, but are key drivers of innovation, risk management, and long-term profitability. Join us as we explore the transformative impact of ESG on businesses and society, illustrating how Technology empowers companies to successfully master ESG challenges.

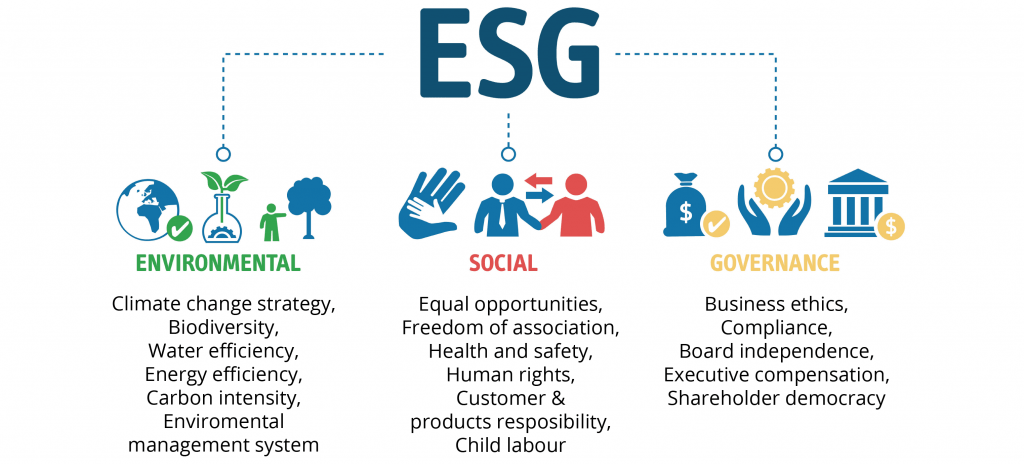

Introduction to ESG

ESG stands for Environmental, Social, and Governance - three critical factors that are increasingly influencing investment decisions, corporate strategies, and consumer preferences. These criteria help gauge the future financial performance of companies, factoring in sustainability and ethical impact.

Environmental Criteria:

This involves looking at how a company performs as a steward of nature. It includes corporate policies addressing climate change, waste management, resource conservation, and animal treatment. The criteria can also serve to evaluate any environmental risks a company might face and how the company is managing those risks.

Social Criteria:

This examines how a company manages relationships with its employees, suppliers, customers, and the communities where it operates. It could include the company's business relationships, working conditions, local communities, health and safety, and employee relations and diversity.

Governance:

This pertains to a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Investors may want to know that a company uses accurate and transparent accounting methods and that stockholders are given an opportunity to vote on important issues.

Why ESG is Important?

Investor Appeal and Access to Capital

There is a growing trend among investors to allocate funds towards companies with strong ESG credentials. This shift is driven by the understanding that ESG factors are indicative of a company's long-term viability and ethical standing. Companies with high ESG ratings may find it easier to attract investors and secure funding at more favorable terms.

Long-term Sustainability and Competitiveness

Embracing ESG is essential for long-term sustainability. Companies that ignore ESG principles may find themselves lagging in a world where sustainability is increasingly becoming a baseline expectation. Moreover, ESG-focused companies often adapt more quickly to changing market and environmental conditions, maintaining their competitiveness.

Brand Reputation and Customer Loyalty

Consumers are increasingly favoring brands that demonstrate a commitment to environmental and social issues. Companies that actively promote their ESG efforts can enhance their brand reputation, build customer trust and loyalty, and differentiate themselves in the market.

a 15% increase in employee engagement, and a 10% increase in shareholder value. (Source: evergreen.so)

Employee Attraction and Retention

ESG initiatives often create a positive work environment, marked by diversity, inclusivity, and ethical practices. This environment can attract talent, improve employee morale, and reduce turnover rates. Companies that are seen as responsible and sustainable employers are often preferred by the current workforce.

Regulatory Compliance and Forethought

With an increasing global focus on sustainability and ethical practices, regulatory bodies are introducing stricter ESG-related requirements. Companies that are ahead in their ESG strategies are better positioned to comply with these evolving regulations, avoiding penalties and staying ahead of the curve.

The Role of Technology in ESG Deployment

In the realm of Environmental, Social, and Governance (ESG) criteria, technology is not just a facilitator but a transformative force. It is a key enabler in the successful deployment and management of ESG initiatives:

Advanced Data Analytics for Environmental Impact

In the sphere of Environmental, Social, and Governance (ESG), advanced data analytics is revolutionizing the way companies approach and mitigate their environmental impact. This sophisticated technology is the backbone of modern environmental management strategies, enabling businesses to not only track but also forecast and mitigate their ecological footprint

Artificial Intelligence in ESG Strategy

AI plays a pivotal role in both predicting future trends and managing current ESG initiatives. AI algorithms can forecast environmental impacts based on various scenarios, allowing companies to adjust their strategies proactively. Similarly, AI-driven analysis can uncover insights into social and governance issues, like identifying patterns in employee feedback or detecting potential compliance risks.

Digital Platforms for Stakeholder Engagement

Digital platforms have revolutionized how companies engage with their stakeholders. These platforms provide avenues for real-time feedback, enable transparent communication about ESG initiatives, and foster community engagement. They are instrumental in building trust and ensuring that a company’s ESG efforts align with stakeholder expectations.

Machine Learning in ESG Compliance

Machine learning algorithms can streamline the complex task of ESG compliance. By analyzing large datasets, these algorithms can identify potential areas of non-compliance, predict regulatory changes, and help companies stay ahead of the curve in terms of ESG-related regulations.

Predictive Analytics for Social and Governance Insights

Predictive analytics can provide deep insights into social and governance aspects. By analyzing trends and patterns, companies can anticipate social challenges, understand stakeholder sentiments, and make data-driven decisions to improve their social and governance practices.

The Future of ESG

The future of ESG is intrinsically linked to evolving global challenges and technological advancements. As environmental concerns grow and social dynamics shift, ESG criteria will likely become even more integrated into the core strategies of companies and investment portfolios. The role of technology in this evolution cannot be overstated, as it provides the tools necessary for effective implementation, monitoring, and reporting of ESG initiatives.

Conclusion

The integration of ESG principles into business practices is not just a trend but a necessary evolution in the face of global environmental and social challenges. With the aid of technology, businesses can more effectively implement ESG criteria, leading to sustainable and responsible growth. Embracing ESG is, therefore, a strategic imperative for companies aiming to thrive in today's complex business environment.

At Tinhvan Software, we understand that integrating ESG principles into your operations is pivotal for not only fostering a sustainable future but also for driving business success. Our commitment is to provide you with cutting-edge technology solutions that seamlessly align with your ESG goals. To learn more about how our ESG solutions can benefit your company, please contact us. Let’s work together to create a sustainable and ethical business landscape.

Source: Tinhvan Software